HOW YOU SHOULD BE PRICING YOUR JOBS

Corey sits nervously waiting for Alex his Accountant to report if it was a successful year this time. Or whether, despite his best efforts, he is still looking for the elusive “extra profit.”

He’s really worked hard and was proud to have finally hit the two million dollar mark for sales.

But deep down, in his gut, he’s just a little worried.

Bank account has been a bit tight lately.

Some of our clients have been shopping around. Comparing prices with other competitors. I’ve had to sharpen the pencil a few times.

There were also a few surprises on some jobs I suspect we lost money on. But hey – we’ve been really busy… So with all the extra work, it should make up for it – right?

Alex puts on his Accounting voice; not a great sign. “I see you’ve billed a lot more this year. In fact 32% more. That’s good. But I see your margins have slipped.”

Okay, so what does that mean?

“You’ve made another $10,000 extra profit compared to last year, but that’s it. I think you might be pricing too low on your work.”

Bugger. Those extra guys I took on last year. And all those late nights and weekends. With nothing to show for it but a measly extra 10 grand!

Corey heads home angry, frustrated and discouraged.

I can’t do another year like this.

There has to be a better way.

If this sounds all too familiar, the first place to start is with your pricing.

As a tradie business owner, the labour allowance you include when pricing jobs (made up of the number of hours allocated to the job – and the actual cost per hour) will be essential in determining how much profit you make this year.

And also the long term success of your business.

If these allowances are too low, no matter what else you do, you won’t be able to make good profits. A sign of this is that cashflow will always be tight, most noticeably at peak times during the month, and also when work starts to slow up.

You’ll find yourself sweating it out. Hoping there will be enough money in the bank to pay staff and suppliers. Ultimately, you’ll find yourself frustrated that profits are disappointing year after year.

Alternatively, if your pricing is too high, you could be losing too many jobs to your competitors.

So how do you work out your labour allowance accurately?

Some base their allowances relative to the experience and skill level of their team. Or what they think the market will pay. Others go on gut feel and adjust pricing according to how much work they have. Some even guess what their competitors’ rates might be and base it on that.

These are factors you should be aware of, but this is not the right way to price and will get you into trouble.

Use these calculations instead:

1) Actual cost per hour calculation

To get this right, you first need to start with your actual costs.

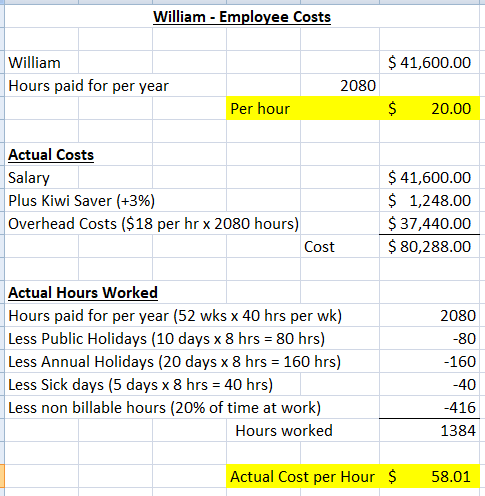

Let’s take a look at William who has been working for Corey, as an example.

William is a good reliable hard worker and gets the jobs done quickly and efficiently.

William works on average 40 hours per week at an hourly rate of $20 per hour which is $41,600 per year.

Corey believes William costs $20 per hour and some extras.

Here is a breakdown of actual costs for William:

Overhead cost calculation: Costs that are not directly related to the jobs (ACC, administration staff, rent, office expenses, advertising, vehicle expenses, etc).

To calculate this accurately for your business, take all overhead expenses for the year divided by total hours spent on the jobs to get an hourly rate. This can range somewhere between $15 – $25 per hour, depending on the size of your company.

Non-Billable hours: Hours not directly related to the job itself (toolbox talks, training, health and safety documentation, onsite meetings, delays in start times and dates where your team is less productive, weather stoppages, material supply delays, etc)

Although Corey initially thought William cost $20.00 per hour + extras, to his surprise the actual costs are $58.01 per hour.

2) Number of hours allocated to the job

Estimating accurately how long a job will take is also essential to making profit.

Every hour worked over the estimated time eats into profit.

Unless hours worked are tracked against the estimated hours for each job, time blowouts are usually not seen (aka backcosting). This is often where tradies get tripped up.

As a business coach, many tradies I work with have significantly increased their profits by getting control of their hours worked on the job and quoting based on newfound understanding of how many hours a job actually takes (as opposed to how long you think it takes).

So check times on every job compared against your time estimates to see how accurate you have been. Then use this history as a guide for quoting for new work.

Putting it all together: Mark up and Profit

Now that Corey understands his labour allowance, he is in a better position to price the job.

Here are the calculations:

Actual cost per hour per employee x Number of hours allocated to the job = Labour allowance

Labour allowance + materials costs = Total cost

Total cost x Mark Up = Total Price to quote client

So start with actual costs and make sure you are pricing right – it will be the difference between being successful – or frustrated with nothing in the bank.

Once you allow for your labour allowance, check your mark up – is it enough? If it’s too low, then it’s time to starting increasing prices and making decent money.

If you need a hand with this, grab a free strategy session with me, and we will go through your situation to make sure you are pricing for profit. Go here